BYE BYE BEN

First, some news and highlights for today…

- The $35B 5-yr note auction sees weak demand garnering a “D” rating.

- Building Permits drop 3.1% in November to 1.007M.

- Housing Starts up a whopping 22.7% in November to 1.091M units annualized, above the 950K expected.

- The 22.7% increase in Housing Starts was the largest rise since January 1990.

- The MBA Market Composite Index fell by 5.5% in the latest week to its lowest level in more than 12 years.

- The MBA refi index fell 4%, while the purchase index declined by 6%.

- Mortgage origination volumes seen dropping by 30% in 2014 to $1.15T, down from $1.8T this year.

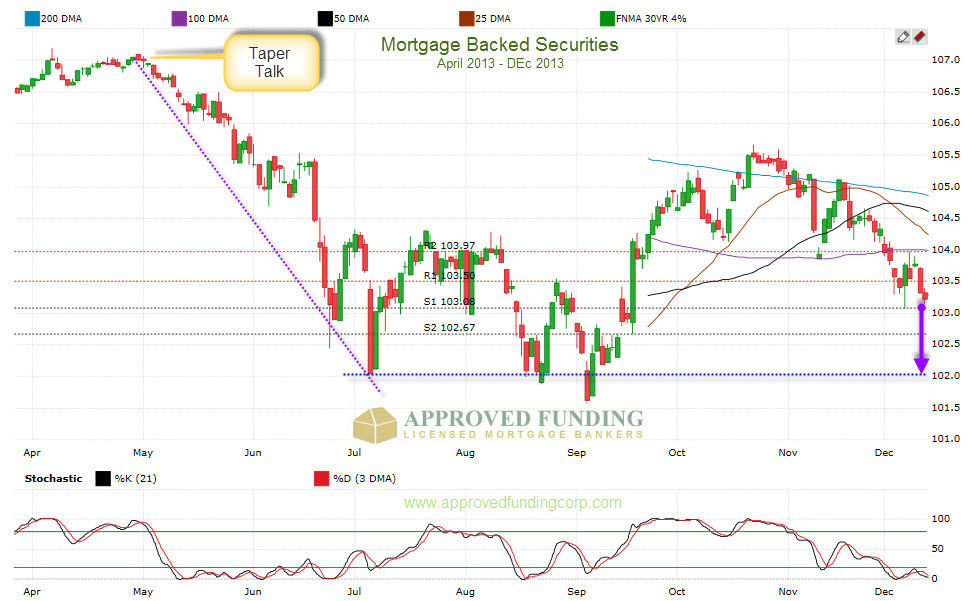

In May after the “Taper Talk” began we lost 250bps in 30 days, and another 250bps over the next 30 days.

We recovered some of that in late Oct/early Nov and are now at 103’ish. We have plenty of ground to lose if the Fed becomes aggressive in their taper plans. (Unlikely though)

Conversely, even if there is no taper now or even if the language is neutral, the talk is that bonds WONT see a benefit because the Taper will happen in Jan or March with certainty.

Lock’em ?? or Lose’em !!

It might not be today, but regardless it seems like Mortgage Interest Rates are on the rise regardless of what happens today.