APPROVED FUNDING CORP. NMLS ID #: 5411

For licensing information, go to: www.nmlsconsumeraccess.org

PRIVACY POLICY

For the Privacy Policy of Approved Funding Corp click here

LEGAL DISCLOSURES

Copyright©2022 Approved Funding Corp. NMLS#5411. 41 Grand Avenue, River Edge, NJ 07661. Toll Free: 800-475-0123. All rights reserved. This is not an offer to enter into an agreement.

Not all customers will qualify. Information, rates, and programs are subject to change without prior notice. All products are subject to credit and property approval. Not all products are available in all states or for all dollar amounts. Other restrictions and limitations may apply. Fairway is not affiliated with any government agencies. Equal Housing Opportunity.

NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES

Website authorization by the New York State Department of Financial Services is pending. Until this website is authorized, no mortgage loan applications for properties located in New York will be accepted through this site.

FAIR LENDING STATEMENT

Approved Funding Corp. is committed to treating all individuals fairly and equitably. As part of our commitment to fair lending, Approved Funding requires its officers, employees, agents, and third parties we do business with to be in compliance with all fair lending laws and regulations.

Approved Funding does not discriminate against any applicant or customer and makes credit decisions without regard to race, color, sex, sexual orientation, gender identity, religion, familial status, political affiliation, marital status, disability, age, veteran status, ancestry, national or ethnic origin, or the fact that all or part of the applicant’s income derives from public assistance programs.

Approved Funding fully complies with all laws applicable to the conduct of its business, including those laws prohibiting discrimination such as the Fair Housing Act and the Equal Credit Opportunity Act.

Approved Funding is a multi-state Direct Mortgage Lender. With two decades of perseverance, we have become one of the area’s fastest growing privately held mortgage banks, by distinguishing ourselves through professionalism, honesty and integrity.

As a privately held mortgage bank we have the same lending authority and ability as any comparable commercial bank. What sets us apart is that we use our power as banker combined with the mindset of a local broker which uses any and all means to find the proper loan program and get the job done. Unlike public lenders and commercial banks we do not need board approval nor do we need to worry about our portfolio or positioning which allows us to close on any loan which we feel makes sense.

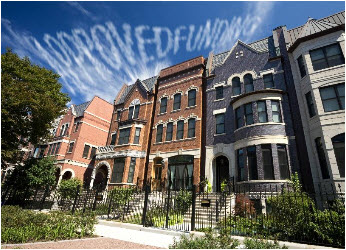

![]() We believe mortgage lending is not a commodity business. Our vision is to assemble the best mortgage banking organization by focusing first and foremost on customer and associate satisfaction. Our growth can be attributed to a business strategy of measured growth, but we truly believe it’s because of something more: Our Values. We believe in three core principles of doing business: Service, Integrity, and Passion. This was accomplished through strategic alignments and a talented senior management team, who are committed to complete customer and partner satisfaction.

We believe mortgage lending is not a commodity business. Our vision is to assemble the best mortgage banking organization by focusing first and foremost on customer and associate satisfaction. Our growth can be attributed to a business strategy of measured growth, but we truly believe it’s because of something more: Our Values. We believe in three core principles of doing business: Service, Integrity, and Passion. This was accomplished through strategic alignments and a talented senior management team, who are committed to complete customer and partner satisfaction.

![]() With almost three decades of satisfactory lending, we have been able to create and negotiate special variances to enhance our lending ability. From alternative documentation types, to extended rate-lock guarantees, to non-warrantable condos – we have the ability to work with any situation and create a custom solution suitable for the overall scope of the project.

With almost three decades of satisfactory lending, we have been able to create and negotiate special variances to enhance our lending ability. From alternative documentation types, to extended rate-lock guarantees, to non-warrantable condos – we have the ability to work with any situation and create a custom solution suitable for the overall scope of the project.

As mortgage bankers, we are the direct lender for all our loans. What this means is that we are in control of the processing, underwriting, closing and funding of each and every loan. Because we are the decision makers on each commitment, we can assist in obtaining streamlined exceptions and making common sense decisions on non-traditional and “out of the box” scenarios.

Visit the NMLS website http://www.nmlsconsumeraccess.org

TEXAS MORTGAGE BANKER REGISTRATION

APPROVED FUNDING CORP IS LICENSED UNDER THE LAWS OF THE STATE OF TEXAS AND BY STATE LAW IS SUBJECT TO REGULATORY OVERSIGHT BY THE DEPARTMENT OF SAVINGS AND MORTGAGE LENDING. CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705.

COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT www.sml.texas.gov. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT-OF-POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBISTE AT www.sml.texas.gov.

WHISTLEBLOWER COMPLAINTS

Please furnish as much detail about the event(s) below.