Freddie Mac released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed mortgage rates holding largely steady for the third straight week amid light economic reports.

News Facts

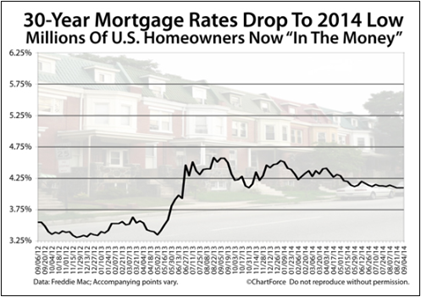

30-year fixed-rate mortgage (FRM) averaged 4.10 percent with an average 0.5 point for the week ending September 4, 2014, unchanged from last week. A year ago at this  time, the 30-year FRM averaged 4.57 percent.

time, the 30-year FRM averaged 4.57 percent.

15-year FRM this week averaged 3.24 percent with an average 0.5 point, down from last week when it averaged 3.25 percent. A year ago at this time, the 15-year FRM averaged 3.59 percent.

5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.97 percent this week with an average 0.5 point, unchanged from last week. A year ago, the 5-year ARM averaged 3.28 percent.

· 1-year Treasury-indexed ARM averaged 2.40 percent this week with an average 0.4 point, up from last week when it averaged 2.39 percent. At this time last year, the 1-year ARM averaged 2.71 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following links for the Regional and National Mortgage Rate Details and Definitions. Borrowers may still pay closing costs which are not included in the survey.

“Mortgage rates were little changed amid a week of light economic reports. The 30-year fixed-rate mortgage rate remained unchanged from the previous week at 4.10 percent. Of the few releases, the ISM’s manufacturing index rose to 59.0 in August from 57.1 the previous month. This was the highest reading of the index since March 2011”, Frank Nothaft, vice president and chief economist, Freddie Mac

Other Market Moving News

In housing news, research firm CoreLogic reported that home prices, including distressed sales, rose by 7.41 percent on an annual basis in July, marking the twenty-ninth consecutive month of year-over-year home price gains. However, prices are still nearly 12 percent below the peak set in April 2006.

And in news overseas, the debt crisis in Europe and continued uncertainty in other regions like the Middle East and Ukraine have helped Mortgage Bonds benefit from a safe haven trade. As a result, home loan rates, which are tied to Mortgage Bonds, remain near some of their best levels of the year.

The bottom line is that now is a great time to consider a home purchase or refinance. Let us know if I can answer any questions at all for you or your clients.