The Fed decided to maintain its bond-buying program and had decided against “tapering” the QE program for now.

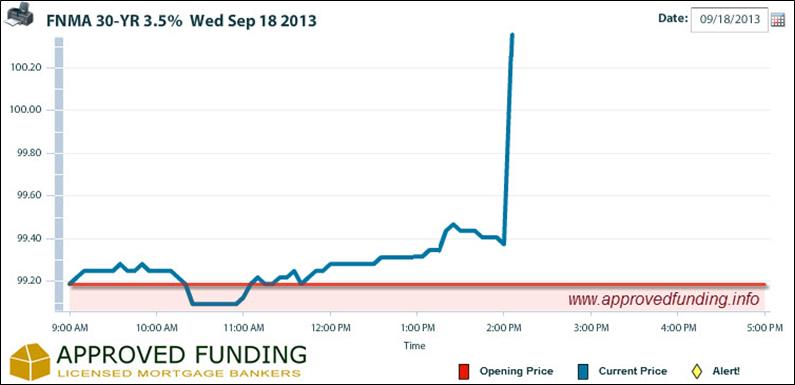

As our intra-day chart shows, mortgage yields jump on the new (making mortgage rates inch lower) …for now…

As always, the devil is in the details – and as of now we have NOT seen any rate improvements as of yet from our investors/banks.

It is likely that traders are pausing on any market move to wait for the 2:30 Q&A session with Bernanke.

Thus far, based on the Fed statement, it is our opinion that this could be a good sign for mortgage rates as this might be a more formal sign that Janet Yellin might have more influence given that she is the potential next Fed chair-person.

Ms. Yellin is known to be in favor of continued stimulus and a much slower and more gradual ease of economic accommodations.

For More Information

[…] not encouraging for the market. This continues to make us believe that the Federal Reserve plan to “taper” back on the mortgage and bond buying programs will be further delayed. We are at a critical point in the mortgage rate cycle and we see continued […]